In today’s fast-paced world, traveling has become an integral part of our lives, whether for adventure, work, or leisure. However, the thrill of exploring new destinations often comes with the challenge of managing finances efficiently while ensuring security. This is where a well-organized travel wallet comes into play, acting as your trusted companion for money management on the go.

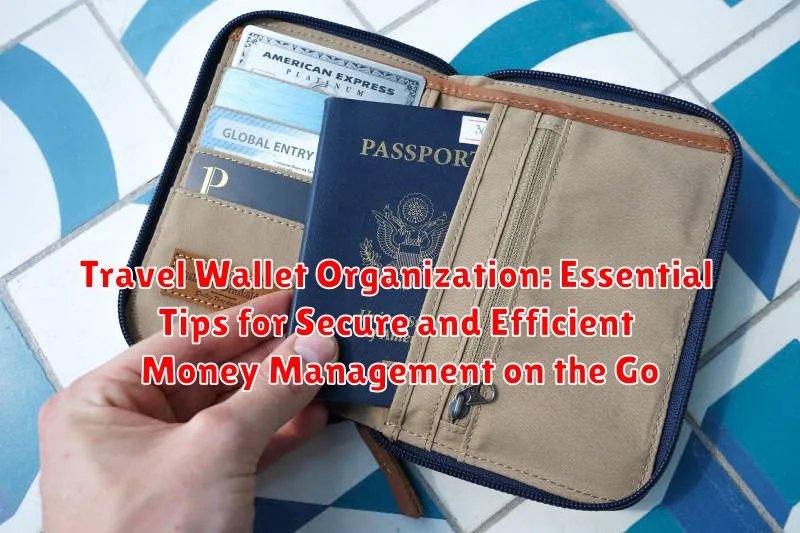

A travel wallet is more than just a place to stash your cash; it’s an essential tool for keeping your travel documents, currencies, and payment methods safe and accessible. By mastering travel wallet organization, you can enhance your travel experience, reduce stress, and stay focused on enjoying your journey. Below are some pivotal components to consider for effective travel wallet management.

Choosing the Right Travel Wallet for Your Needs

Selecting the perfect travel wallet is the first step toward effective financial management during your travels. The market offers a variety of designs, including minimalist cardholders, RFID-blocking wallets, and versatile passport holders. Consider your travel style and destination-specific needs before purchasing.

Material and Durability: Choose materials like leather or high-quality nylon to withstand wear and tear. Ensure the wallet is water-resistant to protect your valuables from weather and accidental spills.

Size and Compartments: Look for a wallet that offers ample compartments for cash, cards, and travel documents while being compact enough to fit in your pocket or bag.

Security Features: Opt for RFID-blocking wallets to safeguard your cards from electronic theft. For added security, consider wallets with built-in locking mechanisms.

Organizing Essential Documents and Cards

A well-organized travel wallet allows quick access to your essential documents and cards, reducing the time spent fumbling through numerous items. Here’s how to keep your wallet clutter-free and functional:

- Prioritize Your Needs: Store only the cards and documents you require for the trip. This typically includes an identification card, driver’s license, credit and debit cards, and insurance details.

- Use Dedicated Slots: Allocate specific slots for different items and label them if necessary. For example, keep your credit cards in one section and your identification documents in another.

- Create Digital Backups: Take photos or photocopies of your essential documents and save them in a secure cloud service. This ensures you have a backup in case of loss or theft.

Securing Cash and Valuables While Traveling

Traveling with cash requires careful handling to avoid loss or theft. Here are some practical tips to secure your cash and valuables:

Diversify Your Storage: Don’t keep all your cash in one place. Split it between your travel wallet, hidden money belts, and secure hotel safes.

Use Anti-Theft Accessories: An anti-theft neck pouch or belt can be a lifesaver. These discreet bags are worn under clothing to protect your cash and small valuables.

Be Mindful of Local Customs: Research local customs and laws regarding currency and financial transactions. Knowing what’s acceptable can help you avoid being targeted by pickpockets.

Utilizing Digital Payment Methods and Mobile Wallets

As technology advances, digital payment methods are becoming increasingly popular for their convenience and security features. Here’s how to integrate them into your travel routine:

“Traveling is becoming more cashless, and understanding digital payments is crucial for a seamless experience.”

Benefits of Mobile Wallets

Mobile wallets, like Apple Pay, Google Wallet, and Samsung Pay, offer a secure and swift method to manage transactions without carrying physical cards. Ensure your mobile wallet is set up and tested before your trip to avoid inconvenience.

Monitor Exchange Rates

Utilize apps that track real-time foreign exchange rates to help decide when to engage in currency exchange. This can save you money, especially on longer trips.

Protecting Yourself from Identity Theft and Fraud

Identity theft is a growing concern for travelers, and taking preventative measures is essential. Here’s how you can protect yourself:

- Avoid Public Wi-Fi: Refrain from accessing sensitive information on public networks. If necessary, use a reliable VPN service to encrypt your data.

- Regular Account Checks: Frequently review your bank and credit card statements for any unauthorized transactions. Early detection is key to preventing major issues.

- Use Password Managers: Avoid using the same password for multiple accounts. Password managers help generate and store strong, unique passwords securely.

Managing Expenses and Tracking Your Travel Budget

Budgeting is crucial for a stress-free journey. Proper management can help prevent financial strain and optimize your travel experience:

Create a Travel Budget

Plan your expenses by category: accommodation, food, transportation, excursions, and a miscellaneous fund for emergencies. Keeping an organized budget allows you to adjust your spending as you go.

Expense Tracking Apps

Leverage apps like Mint or Expensify to track expenditures effortlessly. These tools provide an overview of your spending habits and alert you when nearing budget limits.

Financial awareness ensures you maximize enjoyment and minimize unexpected costs. Remember, preparation is the key to ensuring financial security on your travels!